Crypto Backtesting and Simulated Trading

Put your crypto trading strategies through the ringer

Reduce unnecessary risk by using historical and real-time data to see how your strategies perform in various market conditions.

Historical backtesting

Previous studies

Improve your automated trading strategies by backtesting with historical exchange data. See how your trading strategy handles various types of market volatility. Use different closing price methods to accurately determine the reliability of your script logic.

Concurrent backtesting

Lightning-fast batch testing

Our next level batch testing supports thousands of concurrent backtests of trading robot strategies. Gone are the days of manual testing. Get a more accurate picture of how your trading strategy will perform when deployed on the live market.

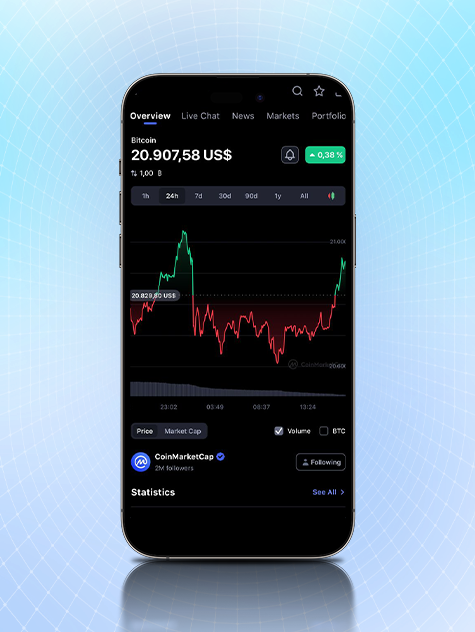

Real-time simulated trading

Trade without risking your capital

Use our paper trading engine with different variations of your trading algorithm to determine how your script handles live market conditions while making adjustments on the fly. Our paper trading engine helps traders gain a deeper understanding of how the algorithm performs with other risk factors such as slippage.